"Navigating the Housing Affordability Crisis: Insights and Future Outlook"

The Housing Affordability Crisis:

A Growing Challenge!

As the owner of Bigueur Realty Group Inc., I'm deeply concerned about the ongoing housing affordability crisis and its impact on our communities. Let's explore this critical issue and look at potential future outcomes for the housing market.

Unraveling California's Housing Challenges

The housing affordability crisis continues to be a pressing issue across the United States, particularly in California. Recent data from the California Association of REALTORS® (C.A.R.) paints a sobering picture of the current situation and provides insights into what we might expect in the coming years.

Current State of Affairs

In 2023, housing affordability in California reached a critical low point, with only 17% of households able to afford the median-priced home. This stark figure underscores the magnitude of the challenge we face in making home ownership accessible to a broader range of Californians.

Factors Contributing to the Crisis

Several factors have contributed to this affordability crunch:

- High home prices

- Elevated mortgage rates

- Limited housing inventory

- Stagnant wage growth relative to housing costs

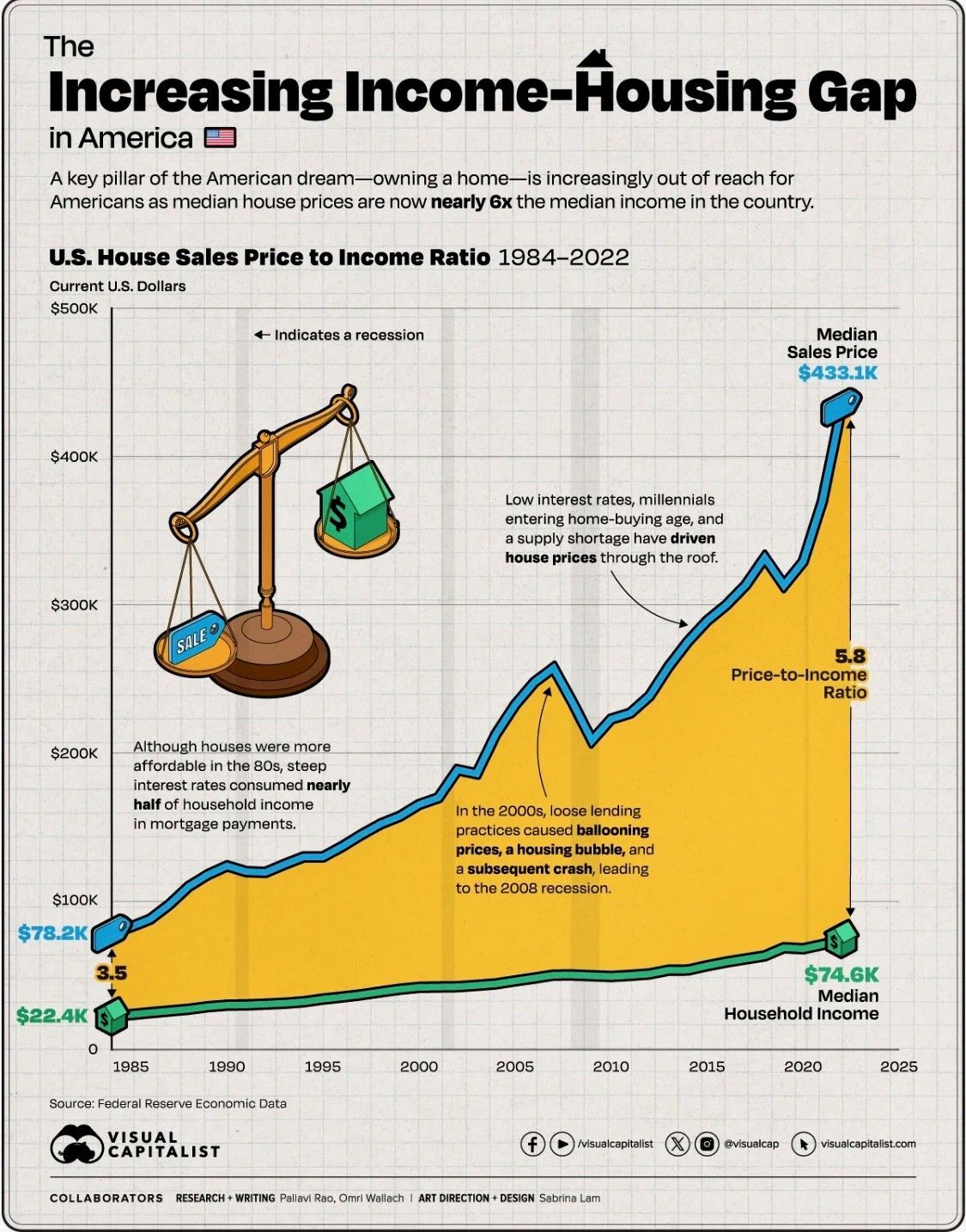

Factor #4: The Impact of Stagnant Income on Housing Affordability

I would like to draw attention to something that I feel has not been addressed enough by the main stream media. The widening gap between housing costs and wage growth has been a significant factor in the current affordability crisis. Let's delve deeper into how stagnant income has exacerbated this issue:

Wage Growth Lagging Behind Housing Costs

Recent data paints a stark picture of the disparity between income growth and housing expenses:

- Between 2019 and 2023, rents surged by 30.4% nationwide, while wages only increased by 20.2% during the same period.

- From 2010 to 2022, home prices rose by 74%, significantly outpacing the average wage growth of only 54% during the same time frame.

This imbalance has made it increasingly difficult for many Americans to afford housing, whether renting or buying.

Minimum Wage Concerns

The federal minimum wage has remained stagnant at $7.25 per hour since 2009, failing to keep pace with rising living costs:

- In 2022, a full-time worker needed to earn $25.82 per hour to afford a modest two-bedroom apartment, which is 3.5 times more than the federal minimum wage.

- This disparity forces many low-income workers to allocate an unsustainable portion of their income towards housing, leaving little for other essential expenses.

Impact on Low-Income Families

The stagnation of wages has hit low-income families particularly hard:

- 87% of renter households earning under $10,000 per year and 67% of those earning $10,000 to $19,999 spend 50% or more of their gross income on housing.

- These families often face chronic instability, struggling to cover basic necessities and living under constant threat of eviction or homelessness.

Regional Disparities

The impact of stagnant wages on housing affordability varies significantly across regions:

- In states like Nevada, home prices rose by 162% from 2010 to 2022, while wages only increased by 47%.

- Urban areas and high-demand markets like coastal California, New York City, and Washington, DC, have seen affordability problems migrate upward, affecting even middle-income earners.

Long-Term Consequences

The persistent gap between wage growth and housing costs has far-reaching implications:

- It contributes to growing wealth inequality, as home ownership becomes increasingly out of reach for many Americans.

- The struggle to afford housing can lead to increased stress, mental health issues, and reduced quality of life for affected individuals and families.

- Communities may face instability as residents are forced to move frequently or become homeless due to housing costs.

Addressing the housing affordability crisis will require multifaceted solutions, including policies to promote wage growth, increase the supply of affordable housing, and provide targeted assistance to those most affected by the disparity between income and housing costs.

Looking Ahead: Potential Outcomes for the Future Housing Market

Mortgage Rates

Mortgage rates are expected to continue falling in 2025, which should improve affordability for borrowers. Specific predictions include:

- The Mortgage Bankers Association forecasts average 30-year fixed mortgage rates could fall to 5.90% by Q4 2025.

- Wells Fargo estimates rates may drop to 5.55%.

Even small decreases in mortgage rates can significantly impact total mortgage costs over time.

Home Prices

Despite falling mortgage rates, home prices are generally expected to continue rising in 2025, albeit at a slower pace:

- CoreLogic predicts home price appreciation will slow to an average growth of 2% for 2025, compared to 4.5% growth in 2024.

- Goldman Sachs analysts project a 4.4% increase in home prices for 2025.

- Fannie Mae's Home Price Expectations Survey predicted price growth of 3.1%.

Housing Inventory

Housing inventory is expected to increase slightly in 2025, which could help improve affordability:

- More sellers may enter the market as mortgage rates decrease, potentially easing the current low inventory situation.

- New construction is expected to be the primary source of increased inventory rather than existing homes.

Overall Affordability

While affordability is expected to improve somewhat in 2025, the housing market will likely remain challenging for many buyers:

- The affordability crisis is expected to ease a little, but significant changes will take time.

- Lower mortgage rates and increased inventory should help improve affordability and reduce the probability of bidding wars.

- However, rising home prices will continue to pose challenges for buyers, especially first-time homebuyers.

Market Conditions

- 2025 is likely to remain a seller's market in most areas due to limited inventory, though some regions may shift towards a buyer's market.

- Total home sales are predicted to increase by 9% in 2025 compared to 2024, according to CoreLogic.

In conclusion, while 2025 is expected to bring some improvements in affordability due to lower mortgage rates and slightly increased inventory, the housing market will likely remain challenging for many buyers due to continued home price appreciation and the lingering effects of the current affordability crisis.

Challenges and Opportunities

While these projections offer some hope, it's important to recognize that the housing affordability crisis won't be solved overnight. Continued efforts are needed from policymakers, developers, and real estate professionals to address this complex issue.

At Bigueur Realty Group Inc., we remain committed to helping our clients navigate this challenging market. We'll continue to provide expert guidance, innovative solutions, and a deep understanding of local market dynamics to help both buyers and sellers achieve their real estate goals.

As we move forward, it's crucial that we work collectively to advocate for policies and initiatives that promote housing affordability and accessibility. By doing so, we can help ensure that the dream of home ownership remains attainable for future generations of Californians.

Stay tuned to our blog for more updates and insights on the evolving housing market. If you have any questions about buying or selling in today's market, don't hesitate to reach out to our team of experienced professionals.